click below to login to your secure account

By Tom Kozlik

Head of Public Policy and Municipal Strategy

Hilltop Securities Inc.

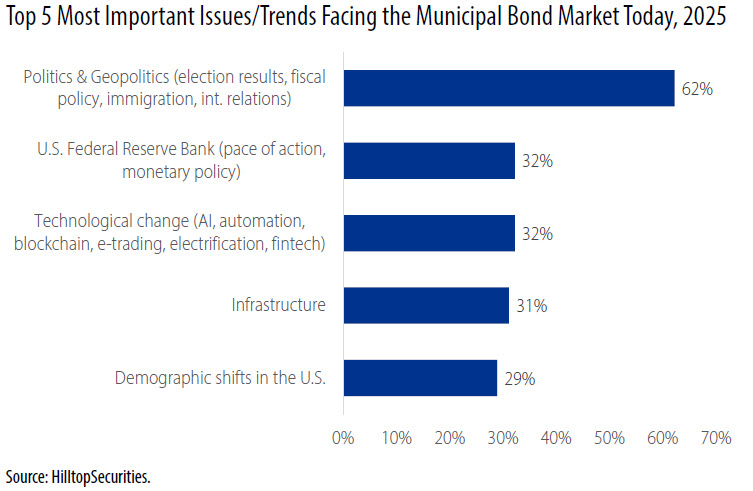

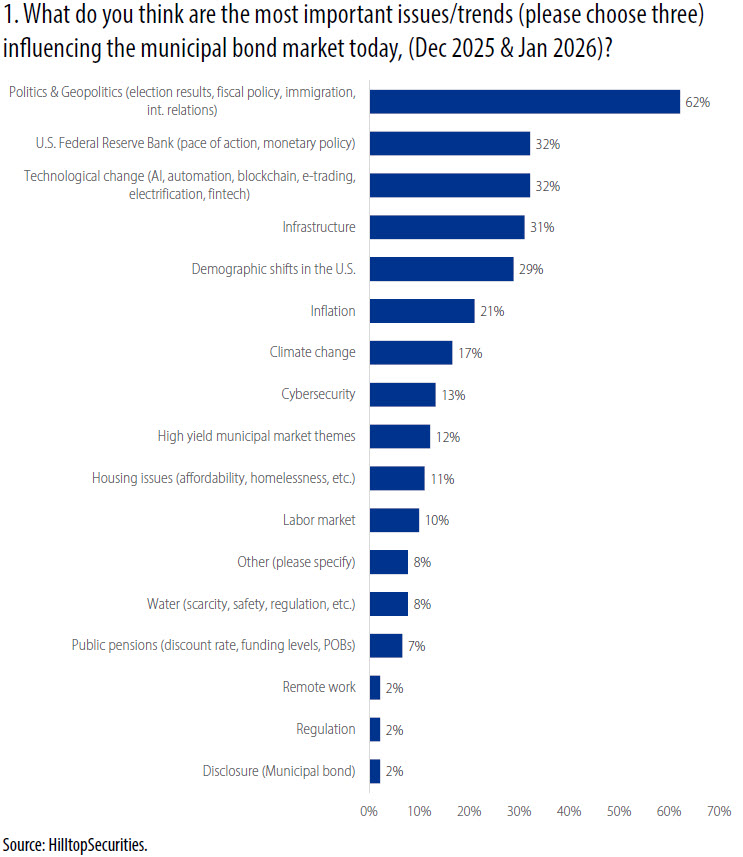

“Politics & Geopolitics” (62%) was cited as the most important issue or trend influencing the municipal bond market right now, based on our survey conducted in Dec. 2025 and Jan. 2026. Last year “Politics” (40%) ranked as the second most important issue or trend influencing the municipal bond market, just behind “Infrastructure” (44%). Public pensions used to be analysts’ top concern year after year. In 2025, only 7% named it as a top issue, down from 17% in 2024.

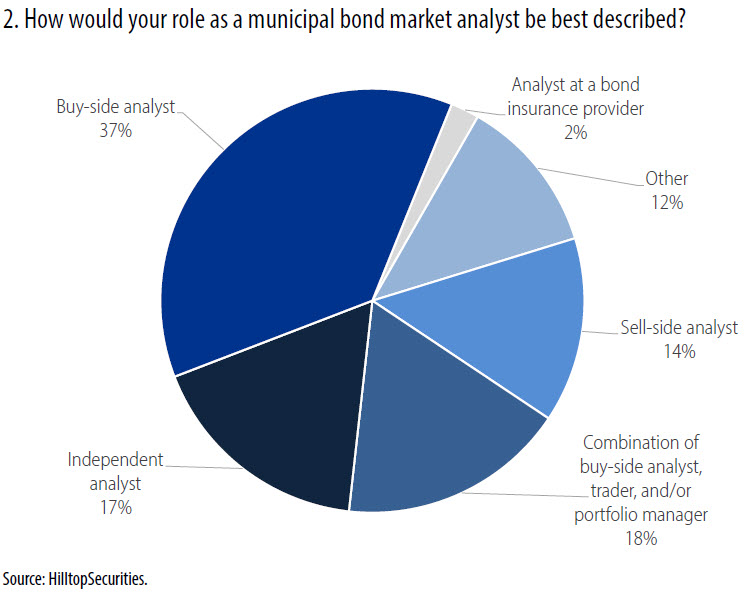

The results are based on a survey conducted by HilltopSecurities in December 2025 & January 2026. The above data was collected from 90 municipal bond credit analysts/ specialists. Analysts from the rating agencies were not asked to participate in the survey.

Please email Tom Kozlik at tom.kozlik@hilltopsecurities.com if you are a municipal bond credit analyst/specialist and would like to participate in the 2026 survey.

We would like to thank everyone who participated in this year’s 2025 Municipal Bond Analyst Survey.

Readers may view all of the HilltopSecurities Municipal Commentary here.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS Public Finance as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP