click below to login to your secure account

By Scott McIntyre, CFA

Co-Head of Investment Management

HilltopSecurities Asset Management

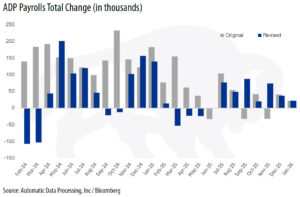

The ongoing partial government shutdown has delayed the release of the government employment report for January, but this week’s private sector jobs data suggest labor market weakness is accelerating amid a backdrop of steady uncertainty.

At this point, it’s hard to dispute the claim that employment conditions have deteriorated significantly over the past six to eight months. This is a consistent theme in both government and private sector reports. The apparent disconnect between solid GDP growth and tepid job creation will sideline Fed officials until more clarity emerges.

The overall employment picture has dimmed, but other recent economic measures are indicating improvement, most notably the ISM factory survey. The January composite manufacturing index (released on Monday) showed factory activity expanded at the strongest pace since August 2022. This unexpected rebound was driven by the biggest percentage jump in the new orders category in almost four years. The employment index rose to the highest level since last January but continued to signal contraction in factory job growth.

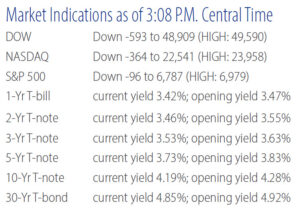

The January employment report from the Bureau of Labor Statistics was rescheduled for February 11, adding to a full slate of economic releases next week. Yields are lower on the day as investors swap a growing list of risk assets for the safety of bonds.

About Scott McIntyre, CFA

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

About Greg Warner, CTP

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

About Matt Harris, CFA

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. and its affiliates. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP.