click below to login to your secure account

By Matt Harris, CFA

Senior Portfolio Advisor

HilltopSecurities Asset Management

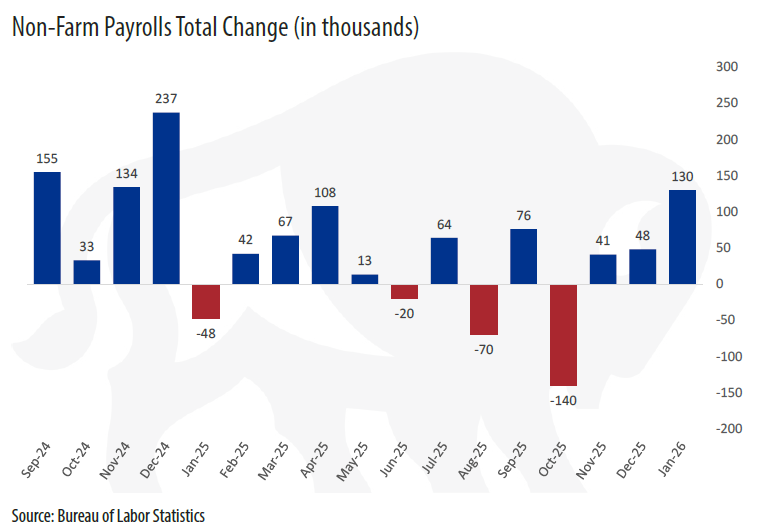

The January employment report from the Bureau of Labor Statistics delivered a strong reading, with payrolls rising 130k against a Bloomberg consensus of 65k, and the unemployment rate declining to 4.3% from 4.4%. The release came a few days late due to last week’s mini shutdown, and only two of the 75 economists surveyed by Bloomberg were looking for a gain this strong.

Job growth came from familiar sectors, with a few surprises. Health care added 82k jobs, social assistance contributed 42k, construction rose 33k, and manufacturing registered its first gain since September 2024. Yet despite these solid headline contributions, the overall growth remains narrow. Much of it is still concentrated in education and health care services, with only half of the fourteen major sectors recording employment gains.

Prior month revisions told a different story. Net two-month revisions reduced prior payrolls by 17k, and the annual benchmark revision subtracted about 898k jobs from the totals, a large downward adjustment that reflects positions that were never actually created, leaving 2025 payroll gains at roughly 181k, or about 15k per month. Even so, the three-month average remains 73k, a solid pace relative to the current breakeven hiring rate of around 50k, the rough level needed to absorb new labor force entrants and keep unemployment steady.

Looking at the household survey, the number of unemployed fell 141k while employment rose 528k, bringing the unemployment rate back near its December 2024 level. Labor force participation improved, which matters because a higher rate means the drop in unemployment was not simply a function of people exiting the labor force.

An additional gauge of slack, the underemployment rate, eased to 8.0% from 8.4%, consistent with fewer marginally attached workers and fewer working part time for economic reasons.

Average hourly earnings rose 0.4% and average weekly earnings increased 0.7% in January, while aggregate hours worked climbed 0.4%. Rising hours often indicate employers are stretching existing staff before committing to more hiring, which is common near turning points. YoY wage growth has been easing from last year’s peaks, supporting the idea of labor market cooling even as month to month readings remain firm.

This report may suggest that last year’s rate cuts helped reinvigorate hiring, but the signal remains clouded by weather effects, government shutdowns, and large revisions. The Federal Reserve will monitor upcoming labor reports closely heading into the March meeting. Market pricing now leans toward the next cut in July rather than June, reflecting the view that policymakers will need clearer evidence of sustained softening, evidence that did not arrive today.

| DOW | Down -201 to 49,987 (HIGH: 50,188) |

| NASDAQ | Down -11 to 23,092(HIGH: 23,958) |

| S&P 500 | Down -9 to 6,932 (HIGH: 6,979) |

| 1-Yr T-bill | current yield 3.46%; opening yield 3.38% |

| 2-Yr T-note | current yield 3.51%; opening yield 3.44% |

| 3-Yr T-note | current yield 3.57%; opening yield 3.51% |

| 5-Yr T-note | current yield 3.75%; opening yield 3.69% |

| 10-Yr T-note | current yield 4.18%; opening yield 4.14% |

| 30-Yr T-bond | current yield 4.81%; opening yield 4.78% |

About Scott McIntyre, CFA

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

About Greg Warner, CTP

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

About Matt Harris, CFA

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. and its affiliates. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP.