click below to login to your secure account

By Scott McIntyre, CFA

Co-Head of Investment Management

HilltopSecurities Asset Management

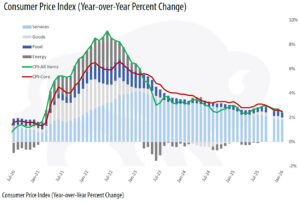

Consumer inflation continues to cool as the overall consumer price index (CPI) rose by just +0.2% in January and +2.4% year-over-year, both numbers a tenth of a percentage point below the median forecast. The annual rate of consumer inflation has fallen dramatically since September, when the headline reached +3.0%. Lower prices in 2026 would allow Fed officials to address labor weakness with additional rate cuts later this year.

Food prices eased in January, up just +0.2% after a +0.7% jump the previous month. The food-at-home index (groceries) was also benign at +0.2%, and +2.1% year-over-year. Beef and veal prices, running hot in 2025, dropped -0.4% in January while high profile egg prices fell -7.0%. The food-away-from-home index (restaurants) followed a huge +0.7% December increase with a tiny +0.1% gain last month.

Energy prices fell -1.5% last month. Within the energy category, gasoline was down -3.2% for the month and -7.5% for the year.

Other categories of interest include a +6.5% jump in airfares, which can be attributed to persistent travel demand, and a +1.2% rise in the personal care index. New car prices rose +0.1% in January after an unchanged reading in December and are now up just +0.4% over the past 12 months. Used vehicle prices fell -1.8% in January after a -0.9% decline in December and are now down -2.0% year-over-year. This drop is in sharp contrast to the +36% surge in used cars and truck prices experienced from 2020-2022.

Shelter costs, representing over a third of the overall index, continue to decelerate, rising just +0.2% in January, bringing the year-over-year advance down to +3.0%. Housing costs have gradually declined over the past three years and are the primary reason why consumer inflation has eased.

Core CPI, which excludes food and energy prices, matched the median forecast with a +0.3% January increase. This helped drive the annual core rate down to +2.5%, the lowest since March 2021.

Oddly enough, the so called “supercore inflation,” a measure of services excluding shelter, rose +0.6%, the biggest monthly increase in a year. In the past, Powell has referred to the supercore reading as “ the most important category for understanding the future evolution of core inflation.” The fact that this subcategory is a little warmer than the headline numbers may give the Fed pause, but this morning’s report suggests consumer inflation continues to move toward the Fed’s +2.0% annual pace.

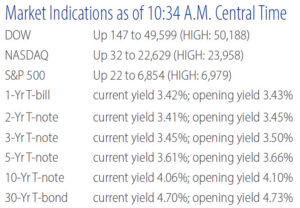

Inflation has a tendency to run hot in January, a month in which businesses typically increase prices, so the fact that CPI was so well-behaved last month is significant. However, rate cuts totaling 75 basis points last fall have yet to fully impact growth and prices, so today’s admittedly cool report is unlikely to prompt Fed officials to resume cuts before June. Bonds are rallying again this morning, dragging yields lower across the curve for the second straight day.

About Scott McIntyre, CFA

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

About Greg Warner, CTP

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

About Matt Harris, CFA

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. and its affiliates. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP.