click below to login to your secure account

By Scott McIntyre, CFA

Co-Head of Investment Management

HilltopSecurities Asset Management

This afternoon’s release of the January FOMC minutes reflect Fed officials trying to navigate an economy that begins the year on surprisingly solid footing, while tariff uncertainty continues to complicate the inflation path. In a 10-2 vote, the committee held the overnight funds rate steady at 3.50% to 3.75%, with two members favoring an immediate 25 bp cut. Those dissents, from Fed Governors Chris Waller and Stephen Miran, highlight the internal debate on whether the monetary policy should be less restrictive as manufacturing and tech employment show signs of softening.

The bond market had largely priced-in a lengthy pause before the meeting, with FedWatch showing a 90% probability of no change at the March meeting. A significant portion of the committee’s discussion in January focused on inflation dynamics. While core inflation continues trending lower, new trade tariffs introduce what several participants described as “one time” or “transitory” price effects that needed to be weighed carefully. The minutes suggested members remain concerned that tariff shocks could evolve into widespread inflation expectations if left unchecked. This concern explains the Fed’s shift away from the series of rate cuts in late 2025 toward a more cautious approach in early 2026.

Economic growth expectations were revised modestly higher, from “moderate” to “solid,” as more recent data pointed to a resilient consumer and firming labor conditions, despite scattered soft patches. Several participants emphasized that the economy was not showing signs of stalling, which contributed to the majority’s view that maintaining the current overnight rate was consistent with both the employment and inflation mandates. However, the minutes also acknowledged that downside risks remain, especially if tariff related disruptions expand or if global conditions deteriorate.

The internal split between policymakers is worth watching. The two dissenters argued that proactive easing would help cushion a cooling labor market and reduce the risk of a potentially sharper downturn later in the year. The majority believe patience is warranted until the committee is able to distinguish temporary price spikes from sustained inflationary pressure. This debate suggests the expected rate path, with the Fed likely on hold until summer, is less settled than headline communications imply.

Finally, Powell used the January press conference to reiterate the committee’s focus on transparency and its dual mandate. He emphasized that policy decisions will continue to be driven by incoming data and that the committee will adjust policy as needed to maintain price stability and maximum employment. While the minutes don’t suggest an imminent pivot, they do indicate a more divided and data dependent committee than any time in recent memory.

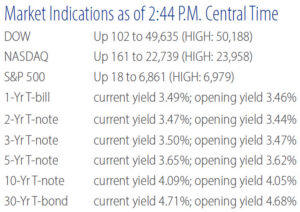

Judging by a muted reaction from the financial markets, the minutes offered few surprises.

About Scott McIntyre, CFA

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

About Greg Warner, CTP

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

About Matt Harris, CFA

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. and its affiliates. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP.