click below to login to your secure account

By Scott McIntyre, CFA

Co-Head of Investment Management

HilltopSecurities Asset Management

In a 6-3 vote, the U.S. Supreme Court announced this morning it had struck down President Trump’s “reciprocal tariffs,” ruling that the International Emergency Economic Powers Act (IEEPA) does not give the executive branch unilateral authority to impose broad global duties. The majority opinion, written by Chief Justice John Roberts, concluded that no other president had invoked IEEPA to impose tariffs of this scale, calling the administration’s interpretation of the near 50-year old statute a “transformative expansion” of presidential power that exceeded congressional intent.

The Court upheld lower court rulings that had previously declared the reciprocal tariffs unlawful, reaffirming that the Constitution reserves taxing powers to Congress unless explicitly delegated. It was made clear that emergency powers cannot substitute for Congress’s constitutional role in setting national trade policy. The justices noted the reciprocal tariffs had no historical precedent and failed established legal tests applied in prior executive power disputes.

While the ruling will prohibit the Administration from using the broad powers under IEEPA, existing tariffs on steel, aluminum, automobiles and other specific industries will remain intact as authorized in the Trade Expansion Act of 1962, which specifically authorizes the President to restrict or adjust imports if they are determined to threaten to impair U.S. national security.

U.S. companies who paid reciprocal tariffs are now expected to seek refunds, estimated at nearly $200 billion. This is where things get complicated as there is currently no mechanism to reverse the collection. Justice Brett Kavanaugh, one of the three minority votes, expressed concern that the refund process was likely to a be mess. Still, the financial markets were granted a welcomed dose of certainty, at least for the time being. The implications of the decisions are many – a wider budget deficit given reduced import tax revenue, a reduction in goods inflation for consumers, and increased certainty and lower input prices for small businesses implying some improvement in economic growth.

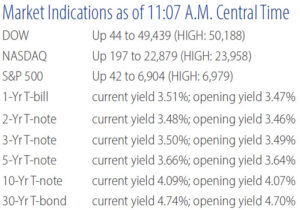

From the Fed’s perspective, the decision provides desired clarity and will be a positive factor when considering future rate cuts. Stocks rose in early trading, surrendered their gains, then rallied again. Bond yields are slightly higher. Neither reaction makes complete sense, although there are multiple catalysts driving investors this morning, and the President is expected to immediately pursue alternative legal means to replace lost tariff revenue.

About Scott McIntyre, CFA

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Scott McIntyre specializes in investment management services and is responsible for the management, oversight and trade supervision of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Scott also provides investment advice and consulting, reviews local government investment policies, formulates overall investment strategies, evaluates account performance and oversees the day-to-day operations. He is a member of the Chartered Financial Analyst (CFA) Institute and a CFA Charterholder, a two-term advisor to the GFOA Treasury and Investment Management (TIM) committee, a Registered Investment Advisor, and holds FINRA Series 7, 24, 63, and 65 licenses.

About Greg Warner, CTP

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

As HilltopSecurities Asset Management’s Co-Head of Investment Management, Greg Warner specializes in investment management services and is responsible for the management and oversight of more than $30 billion in institutional fixed income assets for HilltopSecurities’ public sector municipal clients. Greg coordinates all client services and portfolio management duties, including security evaluation and portfolio analysis, trading, investment reporting, board presentations, and monitoring of broker-dealer relationships. He is an advisory committee member to the Texas Association of Counties, a member of the Government Treasurers’ Organization of Texas (GTOT), a Registered Investment Advisor, a Certified Treasury Professional (CTP) and holds FINRA Series 7, 63, and 65 licenses.

About Matt Harris, CFA

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

As HilltopSecurities Asset Management’s Senior Portfolio Advisor, Matt Harris specializes in investment management services for public sector municipal clients. He developed his experience in the banking industry, supporting balance sheet management, interest rate risk analysis, liquidity planning, and investment strategy implementation. At HilltopSecurities, he works closely with clients to develop and implement customized investment strategies, oversees account documentation and reporting, and assists clients with the public funds depository review process, including competitive RFP evaluations. Harris is a member of the CFA Institute and a CFA Charterholder, a Registered Investment Advisor, and holds FINRA Series 7, 63, and 66 licenses.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. and its affiliates. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP.