click below to login to your secure account

By

Tom Kozlik

Head of Public Policy and Municipal Strategy

Hilltop Securities Inc.

Gary Garay

Head of Municipal Housing Banking

Hilltop Securities Inc.

Every national story has a turning point. Not because of one headline or one election, but because citizens adjust what they believe is possible for their own lives and for their children’s lives.

We are in that moment now.

A Wall Street Journal–NORC poll found that only 25% of Americans believe they have a good chance of improving their standard of living, the lowest reading since the question was first asked in 1987. More than three‑quarters say they do not believe the next generation will be better off than they are.

That is not just “sentiment.” That is the American promise cracking. And if you want a single, concrete reason why, start with housing.

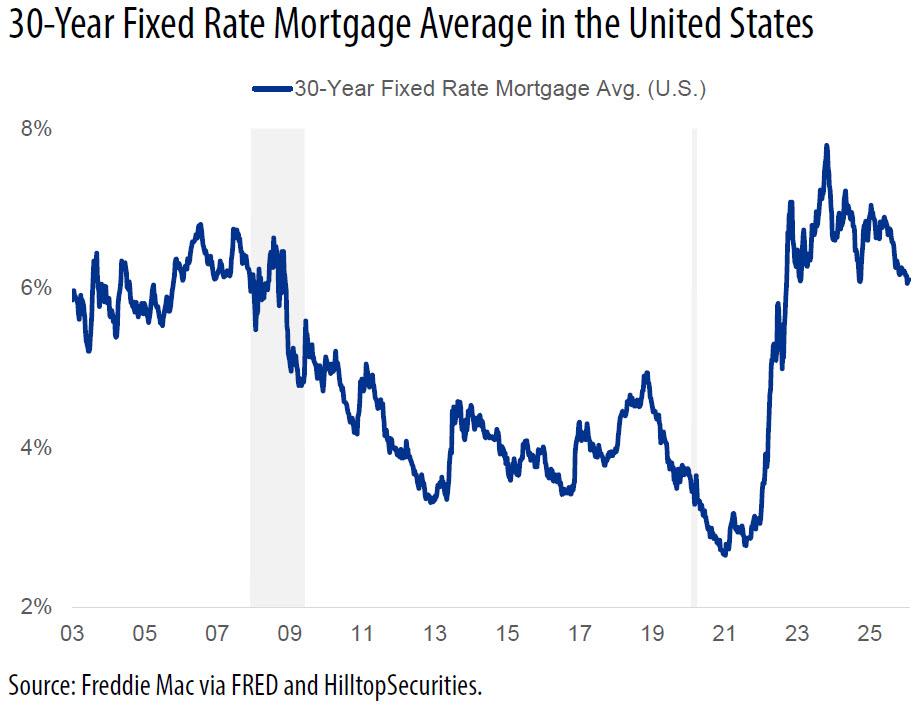

Mortgage rates remain prohibitively high. Freddie Mac reports the 30-year fixed mortgage rate is 6.11% as of early February 2026. For first time, low and middle-income buyers (working families), the financing cost itself has become a barrier.

At this level, mortgage rates function like a moat around homeownership for millions of families.

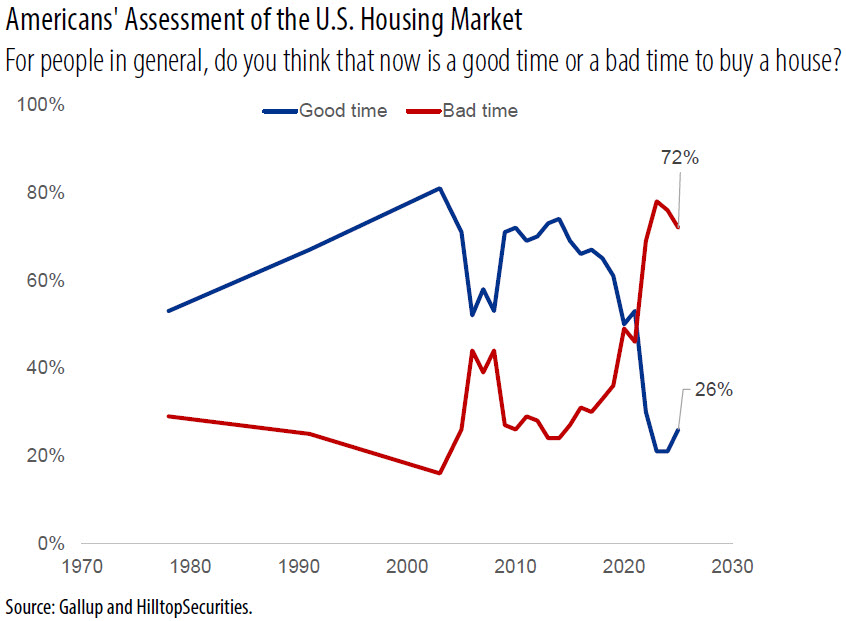

Americans feel it. Gallup found that 72% of people say it is a bad time to buy a house.

The talking heads can discuss GDP growth. They can contemplate the changes in the labor market. Many more people today seem to be talking and interested in the equity and fixed income markets as well.

But when families look at the cost of buying a home and do the math, none of that matters if the monthly payment does not fit within their budget.

The monthly payment is the reality.

And right now, that reality is telling millions of Americans: not yet—maybe never.

Congress is actively working on housing affordability legislation right now, with bipartisan momentum in both the House and the Senate. This is good progress, it matters.

That momentum is not abstract. On Feb. 10, Representatives Rudy Yakym, a Republican from Indiana, and Gwen Moore, a Democrat from Wisconsin, introduced the bipartisan Affordable Housing Bond Enhancement Act. The bill modernizes and strengthens long‑standing housing bond tools to help more working families afford a home.

That legislation is an important step. But it also highlights the next, more structural fix that remains unfinished: removing housing bonds from the Private Activity Bond volume cap altogether.

We need more housing supply.

We need faster permitting.

We need more building types in more places.

But we also need to stop starving one of the most effective housing financing tools we have that can support first-time, low, and middle income homebuyers especially and renters, and that financing tool is: tax-exempt housing bonds.

So here is a simple policy solution that is targeted and overdue:

Carve single-family and multifamily housing bonds out of the Private Activity Bond (PAB) volume cap.

Period. Not a pilot. Not a study. Not a temporary patch that expires right when markets start adjusting. A clean carve‑out that recognizes housing not as a “nice‑to‑have,” but as essential economic infrastructure and as a core pathway to the American Dream.

At a time when labor markets are shifting and technology is accelerating uncertainty, this is a lever Congress can pull that delivers lasting, real‑world impact for families nationwide.

And it would empower state housing finance agencies to lead with more scale—without forcing housing to beg for a slice of a capped pie.

The federal government limits how much tax‑exempt private‑activity debt can be issued each year across the country. That limit forces states into zero‑sum tradeoffs among competing public policy priorities.

Too often, affordable housing ends up coming up short.

That is the point of the cap. And it is also the problem with the cap.

In a national housing shortage, making housing compete in a zero‑sum system is like forcing the fire department to compete and win a grant before buying hoses.

Because housing bonds do two things Americans need right now:

If lawmakers want to restore belief in the American Dream, they need more than slogans. They need monthly payments and financings that work. Housing bonds are not the entire solution. But they increase access for both renters and targeted buyers.

Because we now treat housing as essential in rhetoric, but optional in financing. That is not how prior generations built homes and generational wealth. They had access.

A carve-out does one powerful thing: it ends the “housing versus everything else” knife-fight involved in state volume cap allocations. It gives state governments room to scale what works without taking from other priorities, without waiting for the next crisis, without begging for exceptions.

And it speaks directly to the public mood right now:

This is a chance to put something bold, practical, and pro-family inside that legislative vehicle.

Fiscal policy debates can get abstract fast. “Incentives.” “Allocations.” “Market efficiencies.”

But housing is not abstract.

Housing is where life happens. It is where kids do homework. It is where parents exhale for the first time all day. It is where grandparents stay close enough to be part of the story. Housing is where lives and families and the American Dream are built.

When people lose faith they will ever afford a home, they do not just lose a purchase. They lose a future.

That is the real warning embedded within the WSJ–NORC numbers, that only 25% of Americans think they have a good chance of improving their standard of living.

The Yakym–Moore bill shows Congress already recognizes the value of housing bonds; a volume‑cap carve‑out would allow those tools to finally operate at the scale today’s housing crisis demands.

As Congress negotiates a final housing affordability package—or considers additional provisions through budget reconciliation 2026—lawmakers should include:

A full carve-out of single-family and multifamily housing bonds from the Private Activity Bond volume cap.

If this country is serious about supply, affordability, and restoring faith in upward mobility, this is an effective place to start.

Not because it is flashy. Because it can work through state housing finance agencies.

There is a line in the American story older than any of us: Work hard. Play by the rules. Build something.

Right now, too many people are doing exactly that—and still getting priced out.

We can argue about a hundred policy details. But we cannot negotiate with the math of a monthly payment.

A housing‑bond carve‑out is not the whole answer.

But it is the kind of answer this moment demands. It says:

We see you. We are not giving up on you. And we are going to make it possible again.

Readers may view all of the HilltopSecurities Municipal Commentary here.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS Public Finance as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP.