click below to login to your secure account

By Tom Kozlik

Head of Public Policy and Municipal Strategy

Hilltop Securities Inc.

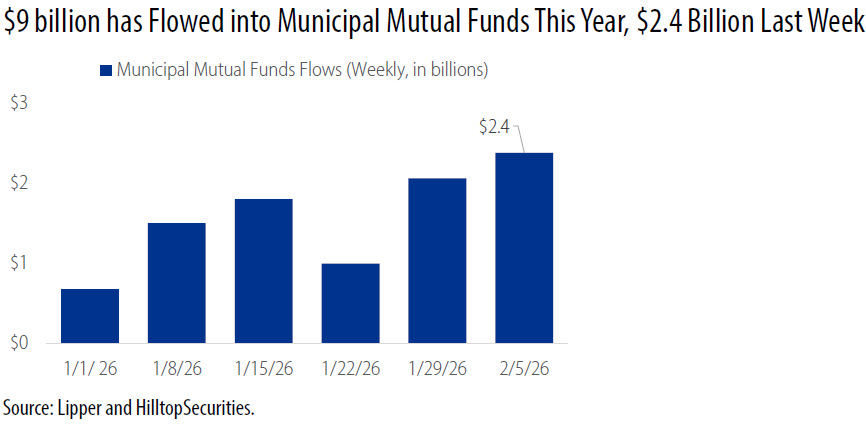

February opened the same way January closed, only with more force. Investors continued to show real confidence in the municipal bond asset class by directing even more investment dollars into municipal mutual funds. The flow did not slow; it actually grew louder as the new month began.

More than $9 billion has already moved into municipal mutual funds this year, including $2.4 billion that came in last week according to Lipper data released on Thursday, Feb. 5. At this point last year, net inflows were about $4 billion. We are already more than double that amount, reinforcing the demand we have expected to build for some time. This weekly momentum is creating a strong backdrop for issuers preparing to come to market in the near term, and it serves as a reminder to investors not to wait if they want to capture generationally attractive tax‑exempt yields. However, as we note below, credit selection is increasingly important in 2026. Also important to note is that primary supply is elevated this week with about $14 billion expected.

The macro-economic mood seems steady enough for patience, even as more voices begin to argue that the U.S. may heat up as the year unfolds.

HilltopSeucurities’ Asset Management Group continues to describe the Federal Reserve’s stance as deliberate patience rather than possessing any form of concern. After the January Fed meeting, Scott and his team noted that the Fed held the federal funds target range at 3.50% to 3.75% and strengthened its language on growth. That upgrade mattered because it signaled confidence. It’s a quiet reminder that the Fed does not see itself in rescue mode.

Late last week, Scott’s team also underscored signs of labor market strain. His recent note pointed toward softening labor momentum, highlighted by the December Job Opening and Labor Turnover Survey (JOLTS), which showed job openings at their lowest level since September 2020.

The U.S. Nonfarm Payrolls report for January, which was delayed due to a government shutdown, is scheduled for release this Wednesday, Feb. 11, 2026, at 8:30 a.m. ET, according to the U.S. Bureau of Labor Statistics. Currently the consensus expectation via Bloomberg is for +68k, a little over the 50k reported for December 2025.

Now layer in the latest thinking from Torsten Slok, the Chief Economist at Apollo. His newest Daily Spark (Sunday, Feb. 8) reads like caution against falling into reflexive pessimism about the U.S. economy. It is a reminder many observers have relearned every year since the COVID‑19 crisis. Slok’s main point: recent software-sector weakness is not the macro story. He argues the underlying U.S. economy could “take off,” powered by three key tailwinds, including already‑committed data‑center financing for 2026 and expansionary fiscal policy.

For fixed income and especially municipal investors, this signal could matter. If the economy runs hot, the market conversation can shift from “when will the Fed cut” to “could the Fed be forced to hike.” Even so, the base case across markets still leans toward easing in 2026. Most expectations call for two more cuts this year, and Fed Funds futures are pricing in nearly a 100% chance of a cut at the June meeting.

HilltopSecurities’ 2026 sector outlooks frame this year as a return to discipline for municipal credit. We published our annual collaboration titled, The Municipal Market in 2026, HilltopSecurities’ Sector Credit Outlooks, at the end of last week. Public entities will need to earn their credit status the traditional way through ongoing structural balance, sustainable revenues, informed decisions, and operating within tighter constraints now that the post‑2020 support has faded.

Credit selection matters more in 2026. Fundamentals remain solid, but stress is building, particularly in K‑12 School District and Higher Education sectors. Public Power carries a “Cautious” outlook now as data‑center‑driven load growth meets execution risk and rate sensitivity. Ratings momentum is normalizing and dispersion is widening. Some issuers will validate the ratings they hold. Others will find that market observers, investors and rating agencies are paying closer attention to trends and footnotes. The distance between “good” and “fine” is growing, and sector‑level differentiation is increasing. For investors, the message is do not rush, but do not freeze, and know the funds and CUSIPs you are evaluating.

Most of the federal government is funded through September 30, 2026 after President Trump signed a broad appropriations package last week, ending the brief shutdown. However, the Department of Homeland Security (DHS) was only given a short two‑week extension, leaving its funding set to expire on Feb. 13, 2026- this Friday. That deadline now drives time-sensitive negotiations on DHS policy and immigration enforcement changes that lawmakers have not yet resolved. We expect discussions to continue this week, and the most likely scenario is another short-term extension, a brief shutdown for only DHS is possible, with hope still for fruitful negotiation that could extend funding.

February’s playbook is about taking a balanced perspective on what may unfold not only through the rest of this month, but into the first half of 2026 and possibly the full year.

It is about respecting what the market is already telling us, especially given the stronger fund flows we have seen in the first six weeks of 2026 compared with 2025. Investor flows remain loud. The reinvestment demand is real. The Fed might cut twice in 2026, but there is also a growing chance it could wait longer than the market hopes. Overall, supply appears to be positioned to keep pace.

A prudent view is needed for February. Do not rush. And do not freeze. And in a discipline year, remember that credit selection is increasingly important. Because 2026 is shaping up to be the year municipal credit quality must be earned again and recognized again by the market.

Readers may view all of the HilltopSecurities Municipal Commentary here.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS Public Finance as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP