click below to login to your secure account

By Tom Kozlik

Head of Public Policy and Municipal Strategy

Hilltop Securities Inc.

Strong investor demand is colliding with a very manageable primary issuance calendar this week. Bonds could be scarce for those looking to put money to work. The calendar is likely to strengthen in February.

Last week Lipper reported that another $994 million was invested in U.S. municipal mutual funds. Nearly $5 billion has flowed into municipal mutual funds in January so far. This is the heaviest January since 2021, when almost $9 billion flowed into municipal mutual funds. Going forward we expect demand to remain steady-to-strong but sometimes demand drops off at the end of the first quarter, partially due to tax-time.

Relative value indicators are not overly appealing, but absolute yields remain near generationally attractive levels despite January’s retreat. The 10-year Municipal to Treasury Ratio (M/T Ratio) ended last week at 63% and the 30-year at 83%. Most AAA Municipal Market Data benchmark (MMD) yields were little changed last week. The shorter maturities edged a little lower. The Bloomberg Municipal Bond Index rose about 5 basis points to end last week, however.

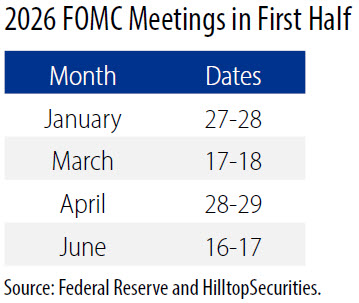

The big event for the week is the FOMC meeting on Jan. 27–28. It will have investors’ full attention. We are not expecting a rate change, and most economists do not expect one either after three cuts late last year. Future moves are likely to be data dependent. The next scheduled meetings are March 17–18 and April 28–29, which are the next realistic windows if conditions warrant. Powell’s tone and signaling will matter most this week. We have been signal hunting for months, and we will be watching closely.

To navigate the rest of January and the beginning of February we think municipal investors should continue to stay focused on the ultimate direction of interest rates, not the timing. That direction is likely lower over the course of the year, not higher but the process could be jagged.

With flows positive and primary supply likely to remain contained near term, we see room for a continued grind in tax‑exempt yields. Practically, that argues for staying engaged when cash is available. We expect this week could be a good time to stay engaged and prioritize high‑quality paper; good bonds still move fast.

We will also be closely watching for signs or even an official announcement about who may follow Powell as chair. His term as chair ends May 15, 2026; he could legally remain on the Board as a governor until Jan. 31, 2028, which is an underappreciated continuity lever. The “who’s next” options have been fluid, but Kevin Warsh is frequently cited as a leading contender right now, with Chris Waller also in the mix. Rick Rieder is now emerging as a top contender as well. The probabilities have shifted with each headline, and comment from the President. The key takeaway for markets is that leadership speculation can color expectations even if policy this week is unchanged.

Bottom line for investors: the combination of fresh inflows, a lighter calendar, and a data‑dependent Fed still supports constructive tax‑exempt technicals. If Powell emphasizes patience and process, we think the “from bracing to building” mood we highlighted earlier in January can extend.

Readers may view all of the HilltopSecurities Municipal Commentary here.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS Public Finance as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP