click below to login to your secure account

By Tom Kozlik

Head of Public Policy and Municipal Strategy

Hilltop Securities Inc.

Risk appetite remains steady to begin this MLK holiday-shortened week, despite the Greenland chatter and the Fed‑chair guessing game. The Supreme Court could issue opinions as early as today Tuesday, Jan. 20, with the challenge to the Trump administration’s global tariffs still pending. Meanwhile, new work from the Kiel Institute finds that U.S. consumers and importers absorbed about 96% of last year’s tariff costs, with foreign exporters bearing only around 4%.

The Federal Open Market Committee (FOMC) meets Jan. 27–28, and the current consensus is for no change after three straight cuts in September, October, and December that set the target range at 3.50%–3.75%. The broader view for 2026 still leans toward lower rates. The debate is timing, not direction as we have consistently reminded readers.

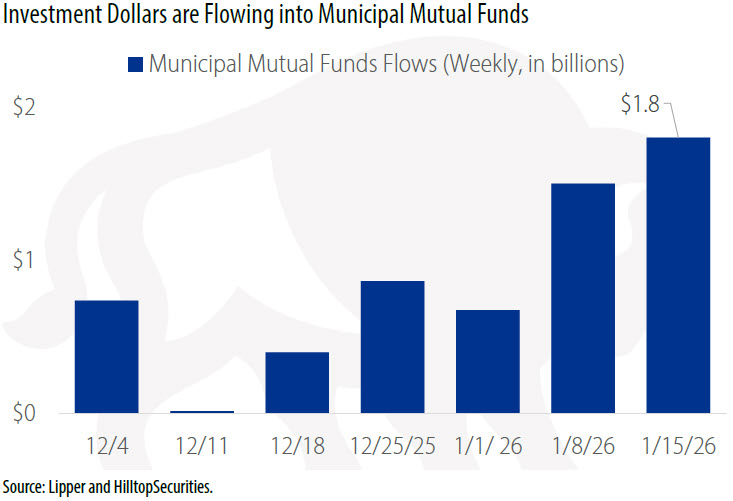

Investors kept buying U.S. municipals last week, and that persistent demand is the story to begin this week. We wrote that investor mood is shifting from bracing to building in our Jan. 12 report, and many investors have set their sights on bolstering municipal portfolios. Appetite for municipal bonds has stayed strong in January. Lipper data shows flows into municipal mutual funds rose to about $1.8 billion for the week ended Jan. 15, after roughly $1.5 billion the week before. On the supply side, the primary calendar is not overwhelming, and January 2026 issuance is on track for the lightest month since the $37 billion we saw in January 2025.

Most importantly, yields are doing what they usually do when firm demand meets lighter supply: they are leaning lower. Municipal yields fell a few basis points last week. Since New Year’s, they are down roughly 15 basis points, which puts levels below the band we tracked from mid‑October through late December. Last week’s move pushed municipals further beneath that range, a break we flagged in our Jan. 12 report after a roughly 10 basis point drop. For those watching the long end of the municipal curve it is important to note that the drop in yields has not been as significant in January. We have only seen the 30 year benchmark AAA yield fall by about four basis points since the start of the month.

This is why the persistent demand in the form of flows into municipal mutual funds story matters. It shows other investors are not waiting. In this case to the tune of $3.3 billion of inflows over the last two weeks. Investors are strategically putting money to work even as headlines tug attention in various different directions. Some investors may still feel the instinct to hold back. But markets rarely hand out safety and value at the same time. Municipals in particular have a habit of improving quietly while investors are looking somewhere else.

This is what we are seeing now. The risk tone remains steady, the Fed meets Jan. 27–28 with no change expected after three 2025 cuts, and the path for 2026 still leans lower. January’s investment flows into municipal mutual funds strengthened while supply stayed light, and municipal yields are about 15 basis points lower year to date after breaking below the fall 2025 range. That mix is doing real work for buyers, which is why our message remains simple: stay engaged, average in for core tax‑exempt income, focus on quality in this environment, set your targets ahead of time and execute when they’re offered or available.

Readers may view all of the HilltopSecurities Municipal Commentary here.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS Public Finance as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP