click below to login to your secure account

By Tom Kozlik

Head of Public Policy and Municipal Strategy

Hilltop Securities Inc.

Investors are looking for and finding positive signs. The tone has shifted in a more constructive direction to begin 2026, relative to the last couple times the calendar turned, for several reasons.

For much of 2025, investors were bracing. Cash‑equivalent investments remained at or near record levels. Many were waiting for the next surprise after being subjected to unforeseen events like major policy headlines, Liberation Day for example, immigration‑related stories, the potential impact of technological change, and other tensions. In some cases, investors were treating every story, announcement, or data release as though it might flip the entire market on its side. That kind of posture is exhausting, and it can lead people to miss the moments when conditions quietly improve.

Now, we are seeing that posture change. Investors are starting to build again. They are eager to add to portfolios. Many are pondering what their portfolios need to look like in a backdrop with positive momentum, one that is less threatened by macro instability and policy uncertainty. This is a welcome shift in outlook.

A few specific drivers are lining up and helping to create this more constructive view. Improved economic growth in 2026 is likely to build on top of 2025’s stable growth. The interest rate environment looks less hostile than it did when inflation was running hot. There is uncertainty related to who will be the Federal Reserve chair later this year, but the trajectory of the Fed’s interest rate target is likely to be lower in 2026. The bigger question is timing, not direction.

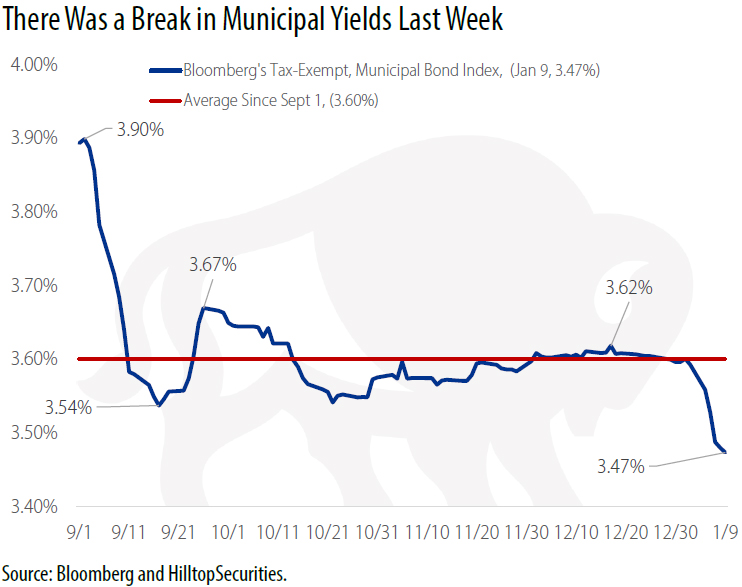

This is where it gets interesting for those focused on the municipal bond market, because of where municipal yields traveled during the first week of the year.

We are seeing demand for municipals build and are expecting that demand to stay firm in January. Municipal yields are still generationally attractive, even though they have broken below the range we have been tracking since mid‑October.

In mid‑December, we indicated municipal yields were range bound and patience would matter as we hunted for clearer signals. The trading range was pretty consistent from mid‑October through year end. The first week of 2026 brought a clean clue as municipal yields fell below the range we had been tracking for months. The move was mainly a result of a supply‑and‑demand imbalance.

This is an important development investors should be aware of. Municipal yields dropped by about 10 basis points last week, mostly because heavy and rising demand is meeting less supply than we have seen recently. It also reinforces the idea that investors need to stay engaged in the market and be ready to act, because the trend for yields is likely to move lower.

The December jobs report was mixed, not dramatic, and it continues to point to a January pause from the Fed. As Hilltop’s Scott McIntyre wrote on Jan. 9, “December’s mixed employment report shows slowing payroll growth and a lower unemployment rate, signaling the Fed will hold rates steady at the January meeting.” Some market indicators agreed, dialing back near‑term cut expectations after Friday’s release.

The Fed is setting the pace. It is authoring market sentiment for now. With the jobs report mixed and inflation well below its 2022 peaks, most expectations point to no January rate cut and a measured approach later in the year. That steadiness lets investors focus on income and selection rather than chasing every data surprise.

Readers may view all of the HilltopSecurities Municipal Commentary here.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS as of the date of the document and may differ from the views of other divisions/departments of affiliates of Hilltop Securities Inc. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP