click below to login to your secure account

By:

Ted Chapman, Investment Grade Specialist

Tom Kozlik, Head of Public Policy and Municipal Strategy

Doug Nelson, Municipal Credit Analyst

Yaffa Rattner, Head of Municipal Credit

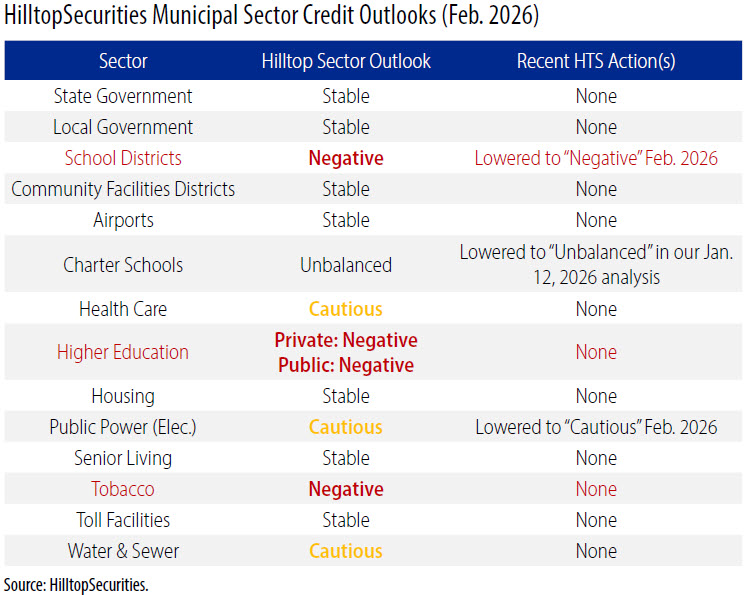

This year could be the year municipal credit quality becomes “earned” again. The golden glow that was left over from the 2020–2021 federal government subsidy sugar-rush has faded, and the market is settling back into something more familiar: credit fundamentals driving dispersion, and once again the importance of credit selection across all public finance sectors.

Municipal bond market credit quality enters 2026 from a position of strength. But the pattern of rating actions, the need for public entities to balance ongoing spending with ongoing revenues, and an uncertain policy backdrop all point to a different kind of year. The next phase of progress will not be inherited. It will come from recognizing the current fiscal reality, a plateau of sorts, and managing it with discipline. That is broadly true across much of the market, but not all of it. Sectors like K-12 School Districts and both Public and Private Higher Education are facing more systemic stress, which we explore in the following pages.

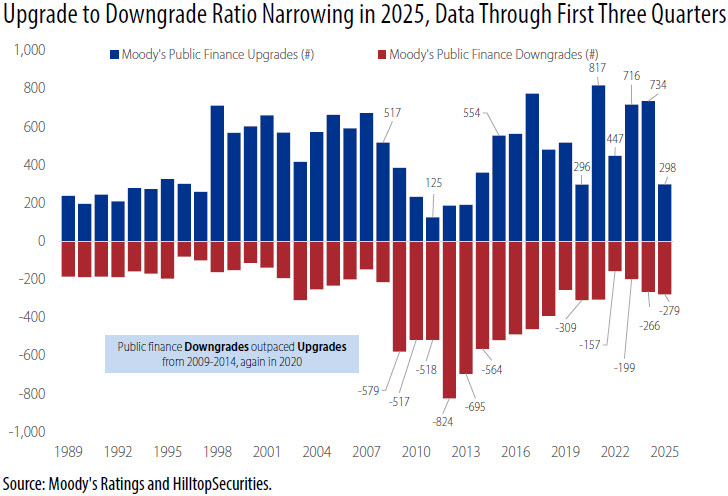

In our January 2025 Sector Credit Outlook, we highlighted that the Golden Age of Public Finance was over. By August 2025, we put a name on the transition: the Post‑Golden Age Realignment. Now you can see the current fiscal reality in the rating upgrade and downgrade activity. Upgrades still outnumber downgrades, but the gap is narrowing as credit strength normalizes and dispersion rises. That supports the view that we are likely past the top of the municipal credit cycle, with the work for investors shifting from the broad uplift we saw in recent years past to issuer-by-issuer differentiation.

We have traveled from the Golden Age, through Realignment and now are at a place where investing in the U.S. municipal bond market requires more discipline, and information, than has been required in years. So, as we step into this new chapter, the key to investor success will be staying agile, well-informed, and ready to adapt to a more nuanced and discerning municipal bond landscape.

U.S. State Government Sector

HilltopSecurities Credit Outlook: “Stable”

Recent Change: None

Author: Tom Kozlik

Last year’s One Big Beautiful Bill Act of 2025 budget reconciliation package removed one big tax policy threat for public finance funding temporarily. But it did not bring clarity everywhere. In fact, it added funding and spending pressures especially through Medicaid, the largest source of federal funding for state governments. New administrative requirements and financing constraints could pressure state budgets in the near and medium term. We are also monitoring FEMA funding and structure developments.

From a fiscal standpoint, U.S. states remain on solid ground. As sovereign governments, they have broad control over revenues and expenditures, and overall credit quality is stable to strong, with only a few outliers. Entering 2026 total balances are lower, but they are still historically high. NASBO’s preliminary estimate for 2026 is $284 billion, or a still‑healthy 21% of expenditures. That is down only modestly from $347 billion and 27% last year. And it remains miles above the 2000–2019 average of $59 billion and 8.7%. States spent down much of the pandemic era subsidy, but some cushion remains. Most state ratings remain strong, and most outlooks are “Stable” or “Positive,” reflecting deep reserves and generally disciplined financial management. Still, a handful of states carry larger‑than‑average credit challenges, which is why credit selection continues to matter.

Looking ahead, our baseline for 2026 is a mostly stable operating environment. We are watching closely to see how states balance revenues with expenditure demand. At the same time, we are monitoring a handful of potential emerging risks that could test budgets: a softening labor market, whether driven by artificial intelligence adoption or tariff policy; and a meaningful equity market decline that could pressure income tax collections and consumer spending. Finally, federal policy remains a key question. Unforeseen federal action could complicated budget pressures.

U.S. Local Government Sector

HilltopSecurities Credit Outlook: “Stable”

Recent Change: None

Author: Tom Kozlik

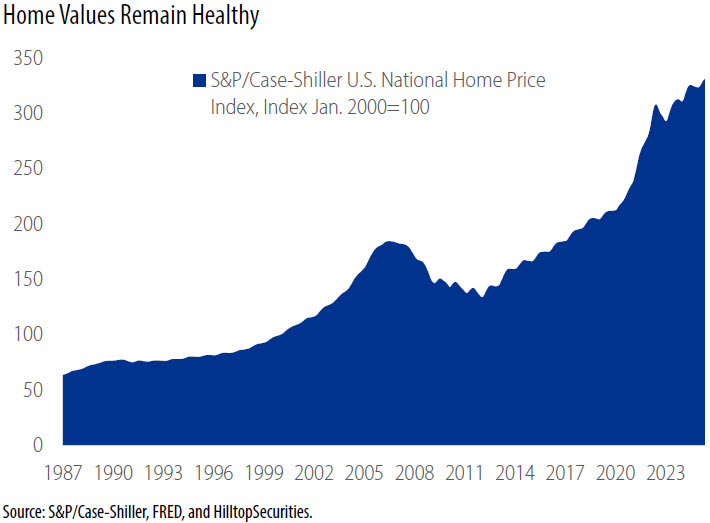

For the U.S. Local Government Sector, the base case we are expecting this year is steady and balanced, not spectacular. Property taxes remain the anchor as home values stay elevated, even as property valuation growth cools in some areas. The bigger swing factor is labor. In HilltopSecurities’ 2025 Public Finance Leaders Survey, finance leaders again ranked Labor/Staffing as the top challenge, and compensation costs for state and local governments continue to rise, which makes budget discipline more important in 2026 than it has been in the recent past.

The federal backdrop remains a stabilizer in the aggregate, but it is not a straight line. Policy shifts and disaster-aid uncertainty could create issuer-specific cash-flow questions and higher costs, especially for smaller entities and for smaller events that may not qualify for federal support. Classic concerns about willingness versus ability could also build. Affordability and lingering inflation pressures, combined with aging demographics, may constrain revenue growth even in middle and higher-income communities. In some places, the constraint may not be a weak tax base. It could be practical limits related to public support. Credit differentiation can show up first here, and sometimes this is a qualitative read, not a quantitative output.

A potential supportive tailwind is the AI and data center build‑out. McKinsey estimates roughly $6.7 trillion of data center infrastructure capex globally through 2030, and how much of that lands in any given region in the U.S. will hinge on corporate siting decisions, power and water readiness, and state and local tax structure. We are watching these elements closely, because the Tax Foundation’s work is well defined: tax policy can attract or repel these projects at the margin, and that matters for local tax base, infrastructure planning, and long‑term growth.

U.S. School Districts

HilltopSecurities Credit Outlook: “Negative”

Recent Change: Lowered to “Negative” from “Cautious” in this analysis.

Author: Ted Chapman

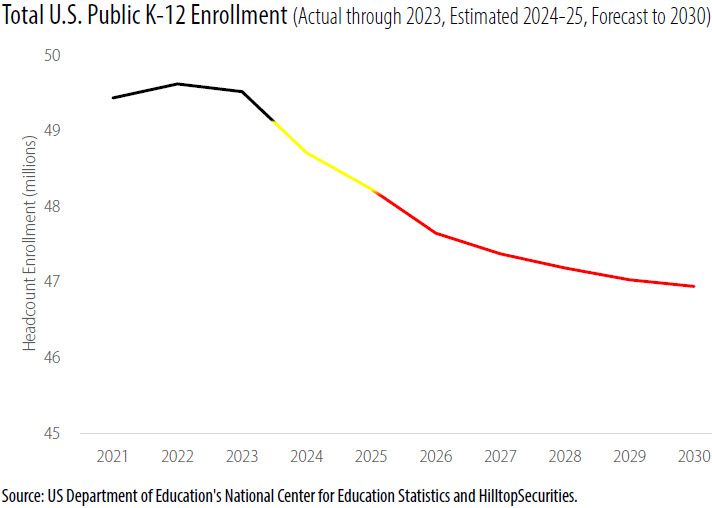

Credit stress continued to mount in the U.S. school district sector last year. As a result, we lowered our sector outlook to “Negative” from “Cautious” in this analysis. This follows our January 2025 move to “Cautious” from “Stable.” Our current “Negative” outlook reflects a set of pressures that, taken together, point to continued deterioration and a period in which we expect credit downgrades to outpace upgrades. The core driver is demographic, and enrollment change colliding with cost structures that do not shrink quickly. Districts can adjust over time, but the near-term is often the hardest part because the most effective solutions are also the most difficult to execute. Key pressures we are watching include:

Community Facilities Districts

HilltopSecurities Credit Outlook: “Stable”

Recent Change: None

Author: Doug Nelson

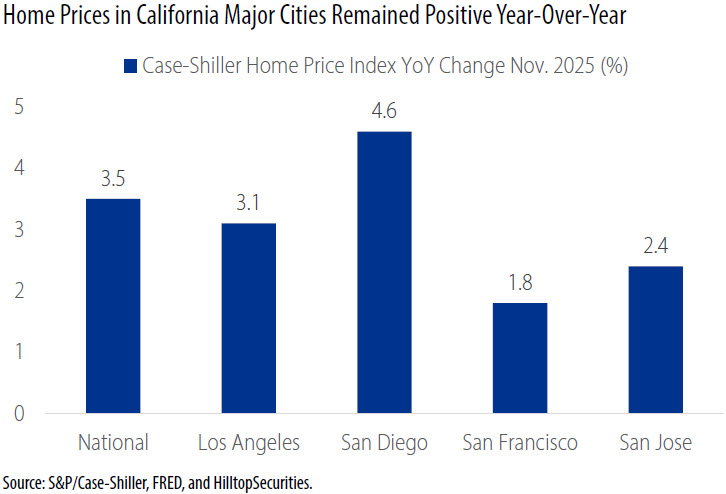

Community Facilities Districts or CFDs provide infrastructure financing, mainly for residential developments in California. CFD debt is repaid with special taxes that are levied based on parcel size, as opposed to property taxes that are levied based on property value, however, one metric of the creditworthiness of CFD debt is the value-to-lien ratio, which is the ratio of assessed valuation to debt outstanding of the district.

Demand for housing continues to be relatively strong in California due to housing shortages in various high-demand areas of the state. The decreased mortgage rates could further increase demand. Affordability and development restrictions (based on water availability, local zoning and other factors) have hampered growth in some areas.

Commercial and industrial property values have stabilized, so value-to-lien ratios for commercial and industrial CFDs are stable. Home prices and property values in California continue to grow, albeit at a lower rate than in the past. Overall, value-to-lien ratios have improved. The outlook for CFDs remains “Stable” to begin 2026.

Airports

HilltopSecurities Credit Outlook: “Stable”

Recent Change: None

Author: Doug Nelson

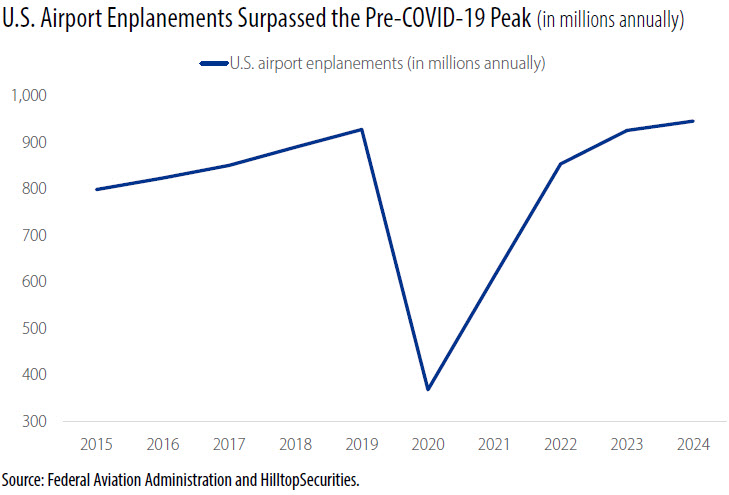

Even with flight reductions pursuant to Federal Aviation Administration (FAA) directives amid the federal government shutdown during the fourth quarter of 2025, the credit quality of U.S. airports remained stable. Fully staffing air traffic control centers and security operations served by federal agencies remain a challenge, however. FAA grants to U.S. airports in 2025 were approximately $11.7-$12.0 billion in total.

Airports sold nearly $24 billion of debt in 2025, and significant issuance is expected in 2026, however the debt burden remains manageable. Many airports are in the midst of renovating and/or expanding facilities due to aging infrastructure and increased utilization.

Total enplanements in the U.S. have finally passed pre COVID-19 pandemic levels. The Congressional Budget Office is projecting Gross Domestic Product (GDP) growth in the U.S. to be approximately 1.8% in 2026. Historically, GDP has been a good indicator of traffic at airports, so volume should continue to grow, but at a lower rate. We kept our sector credit outlook for the Airport sector at “Stable” again to begin this year.

Charter Schools

HilltopSecurities Credit Outlook: “Unbalanced”

Recent Change: Lowered to “Unbalanced” from “Stable” in our Jan. 12, 2026th analysis

Author: Yaffa Rattner

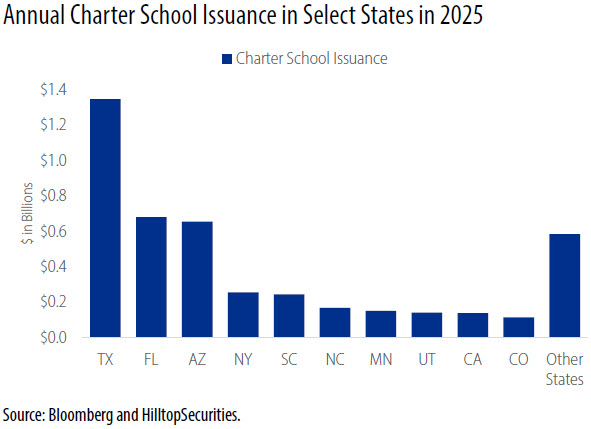

HilltopSecurities has revised its credit sector outlook for the charter school sector from “Stable” to “Unbalanced,” signaling growing divergence in credit quality across states. This outlook covers approximately $4.6 billion in debt issued in 2025 and an expectation of a similar issuance trend in 2026. Five states: California, Texas, Florida, Arizona and New York account for over 1.9 million or 50% of the 3.87 million charter school enrollment and 62% of the 2025 debt issuance. Therefore, it is critical to focus on individual state fiscal pressures and demographic trends, which we believe will inform the 2026 financial flexibility and stability of charter schools.

Our outlook for charter schools located in Texas and Florida is “Stable.” These states continue to experience robust population growth, higher student enrollment and increased charter school funding.

In contrast, certain states including New York, California, Illinois and Pennsylvania are facing fiscal and demographic challenges. These states face budget pressures which can constrain charter school funding.

The bifurcation of charter school credit profiles will increasingly reflect local economic conditions, state funding priorities, and demographic patterns. As a result, charter school credit quality will require careful assessment of demographic changes, state budgetary environment, and an assessment of management who will be ultimately responsible to maintain fiscal health, student enrollment and academic excellence.

Health Care (Investment Grade)

HilltopSecurities Credit Outlook: “Cautious”

Recent Change: None

Author: Doug Nelson

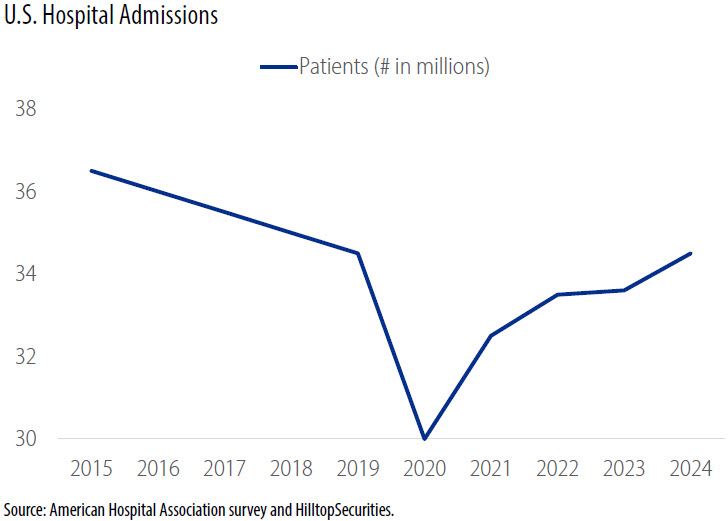

A recent study by researchers at Hunter College, Harvard Medical School, and Public Citizen’s Health Research Group suggests the cumulative financial strain of healthcare is more widespread than annual snapshots indicate-and most Americans will experience unaffordable health care costs during their lifetimes.

The unaffordability of healthcare along with increasing healthcare insurance premiums, the possibility of Medicaid cuts and lower Medicare reimbursements could put financial strain on healthcare providers. There is still uncertainty concerning possible federal legislation regarding subsidies and government payors. Some states may try to backfill gaps created by federal changes, but not all states have the fiscal capacity to do so at scale. On the plus side, demand for healthcare will continue to be strong due to the aging demographics of the U.S. population. Management teams must control expenses, especially labor costs to offset the pressure of reduced revenues.

Overall, margins have gradually improved in the sector, and liquidity is adequate at this point. Fitch Ratings outlook on this sector is “Neutral”, and Moody’s and S&P Global both have “Stable” outlooks. Our credit sector outlook on the Health Care (Investment Grade) sector remains “Cautious.”

Higher Education

HilltopSecurities Credit Outlook: Public “Negative” and Private “Negative”

Recent Change: None

Author: Tom Kozlik

Higher education remains in a negative cycle, and the uncertainty around the sector is even greater today than it was in September 2024 when we indicated the non-profit U.S. Higher Education sector was encountering severe systemic pressures. We still believe both public and private institutions are affected, but mostly it is the smaller private institutions which are still experiencing the most significant credit stresses, leading to what can be described as an existential crisis.

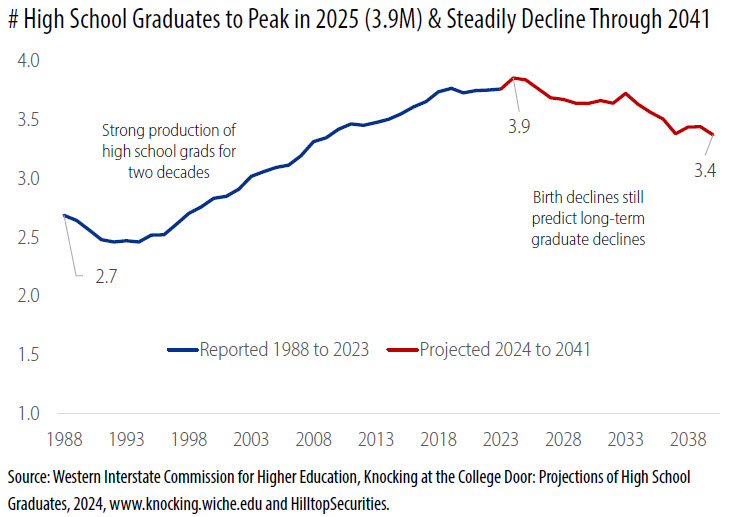

The central pressure point remains enrollment. The number of high school graduates is forecast to continue to trend lower until 2041. Declines and intensified competition are constraining pricing power, particularly for tuition-dependent institutions and those located in demographically weaker regions. When the student pipeline narrows, the math gets unforgiving and there are fewer viable paths that do not involve consolidation, program reductions, or even mergers. Policy and funding uncertainty add another layer of volatility. Federal scrutiny and enforcement actions, research funding disruption, and softer international student trends increase operational risk and complicate long-range planning. At the same time, changes in student lending could shift demand for certain graduate and professional programs that many institutions have relied on.

None of this means higher education is going away. Flagship publics and wealthier private universities will generally retain flexibility through scale, selectivity, technology, philanthropy, and stronger balance sheets, and they can adapt faster when conditions change. But across the middle and lower tiers, we expect more institutions will be forced to make difficult decisions sooner, and we continue to expect downgrades to outpace upgrades in 2026.

Housing

HilltopSecurities Credit Outlook: Stable

Recent Change: None

Author: Tom Kozlik

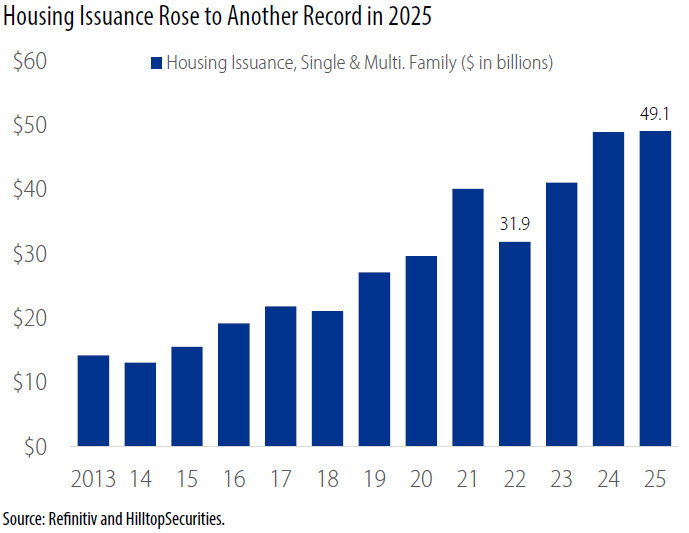

In last year’s outlook, we wrote that 2025 could be a very busy year for State Housing Finance Agencies (HFAs). It was. Issuance set another record, narrowly topping the prior high set in 2024. From our position, there is no reason to think 2026 cannot be similarly active. The path of issuance this year will again run through the same four key variables: interest rates, loan demand, a healthy economy and labor market, and volume cap limitations. Interest rates may drift lower, demand for loans remains healthy, and economic growth could be as strong, or even stronger, than 2025. This combination sets the housing sector up well for 2026.

HFAs remain one of the most practical tools states have to address housing affordability. They continue to compete well for targeted borrowers, especially first-time and lower-income homebuyers, and down payment assistance strengthens that value proposition. On the multifamily side, activity could get an added lift as 2025 budget reconciliation changes to the Low-Income Housing Tax Credit (LIHTC) begin to take hold. To Be Announced (TBA) execution and the market for specified mortgage backed securities (MBS) pools continues to be an important tool for state housing finance agencies. It helps them manage their federal volume cap limits and reach a wider range of homebuyers. Right now we are also seeing strong investor demand for HFA MBS pools that offer call protection. Mortgage rates are sitting near three year lows, which raises the chance that borrowers could refinance. Because of this, some investors prefer HFA pools where the early payoff risk is lower than in standard, generic MBS.

From a credit standpoint, HFA balance sheets and fundamentals should remain solid to strong. The non-profit housing sector remains one of the strongest sectors in the municipal market. We are watching three things: delinquencies (expected to stay low), modest margin pressure if rates fall, and federal fiscal and political developments, which remain a wild card.

Public Power (Electric)

HilltopSecurities Credit Outlook: “Cautious”

Recent Change: Lowered to “Cautious” from “Stable” in this analysis

Author: Ted Chapman

It is possible that our view on the Public Power (Electric) sector improves as federal policies become clearer. The President’s January 2026 directive whereby one of the larger U.S. grid operators would in the third quarter of 2026 hold auctions for 15-year contracts for generating capacity specifically for data centers could set a precedent for power plant construction for years to come. The hope from the White House’s “statement of principles” is that $15 billion in new solid fuel baseload generation will get built in the PJM regional transmission organization that serves about 65 million people across 13 states, mainly in the Great Lakes and Ohio River Valley states. Meaning, a “growth pays for growth” could greatly ease the affordability-related concerns from residential customers’ collective groans over rising prices, even if it does not ameliorate the fact that the generating and related transmission facilities still have to be permitted and built.

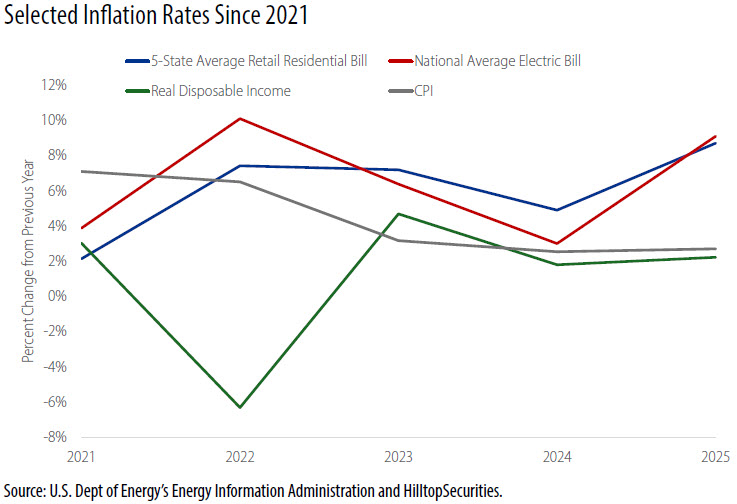

Retail electric rates have increased despite the relatively stable price of natural gas; the two commodities began diverging sharply in 2023, which – coincidentally or not – saw the “birth” of generative artificial intelligence applications such as ChatGPT. We have highlighted the average residential price of electricity in the five states that have seen the most new hyperscale data centers that have gone into service or been announced since 2021: Virginia, Texas, Oregon, Ohio and Iowa. The average of those five states has clearly outstripped both real disposable income and overall CPI, but is not meaningfully different from the overall still-steep national average increase. We expect the price of electricity could be a meaningful talking point in the 2026 midterm elections just as the price of eggs was in 2024, because it is very likely that the full cost of the infrastructure demands of these high load customers has yet to be felt.

Senior Living

HilltopSecurities Credit Outlook: “Stable”

Recent Change: Unchanged in our Jan. 26, 2026 analysis

Author: Yaffa Rattner

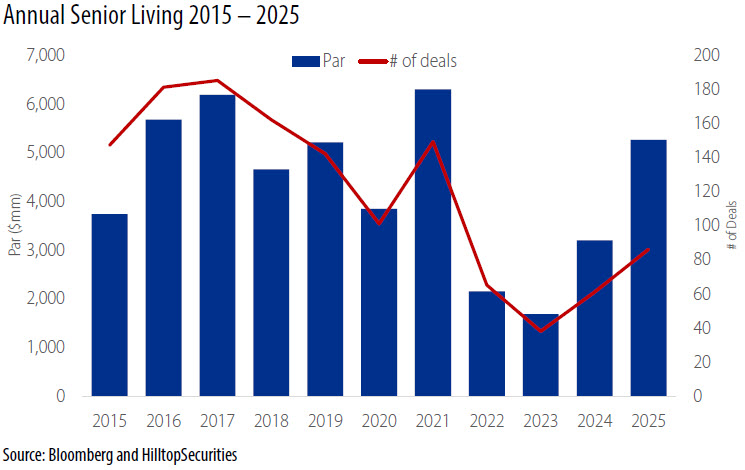

HilltopSecurities affirms its “Stable” outlook on the Senior Living sector, following our 2025 upgrade to “Stable” from “Cautious.” The maintenance of our “Stable” credit sector outlook reflects sustained increases in occupancy exceeding pre-COVID levels, higher monthly community revenue, and stabilized expense pressures, including labor and food costs. This outlook is especially relevant given the 65% growth in sector debt issuance in 2025 adding to the almost 60% growth in senior living issuance in 2024, a trend that is expected to continue into 2026. Our “Stable” outlook also reflects the 72% reduction in year over year senior living related defaults as the sector continues to benefit from revenue growth and expense stabilization.

For calendar year 2025, a total of $5.3 billion in senior living debt was issued across 67 transactions. Non-rated issuance saw a significant increase, more than doubling to $3.4 billion to $1.2. In addition, average non-rated deal size increased to $67 million from $52 million in 2024. Given the rise in non-rated debt issuance, it is crucial to remain vigilant on deal credit features. We underscore that credit assessment of each project remains vital for determining security investment and risk appetite.

Tobacco

HilltopSecurities Credit Outlook: “Negative”

Recent Change: None

Author: Doug Nelson

Health concerns, high taxation and regulations continue to negatively impact tobacco consumption in the U.S. In early 2025, the Food and Drug Administration (FDA), which has regulatory authority over tobacco, withdrew its proposed ban on menthol cigarettes and flavored cigars. Massachusetts and California have full statewide bans on menthol cigarettes. Over 400 U.S. local jurisdictions ban or restrict the sale of menthol cigarettes. The FDA has the authority to set maximum nicotine levels and nicotine-reduction standards remain under study. There is no nationwide cap on nicotine at this time. The FDA has marketing and advertising restrictions on tobacco products. The weighted average price of a pack of cigarettes is approximately $9.82-$10.25 and the tax burden is approximately 34-36% of the retail price.

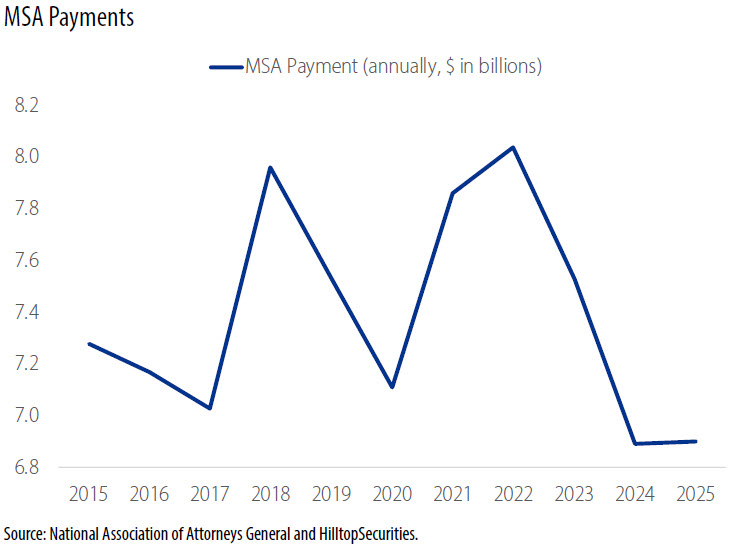

Tobacco bonds are secured by annual payments made by tobacco companies under the Master Settlement Agreement (MSA). MSA payments did increase a few years ago due to inflation adjustments and a temporary increase in consumption during the COVID-19 pandemic. Tobacco shipments seemed to stabilize in 2025, but MSA payments should continue a normalized decline going forward due to decreased cigarette use in the U.S.

Our credit sector outlook for the Tobacco sector remains “Negative” due to the consistent headwinds facing outstanding issuance in the sector.

Toll Facilities

HilltopSecurities Credit Outlook: “Stable”

Recent Change: None

Author: Ted Chapman

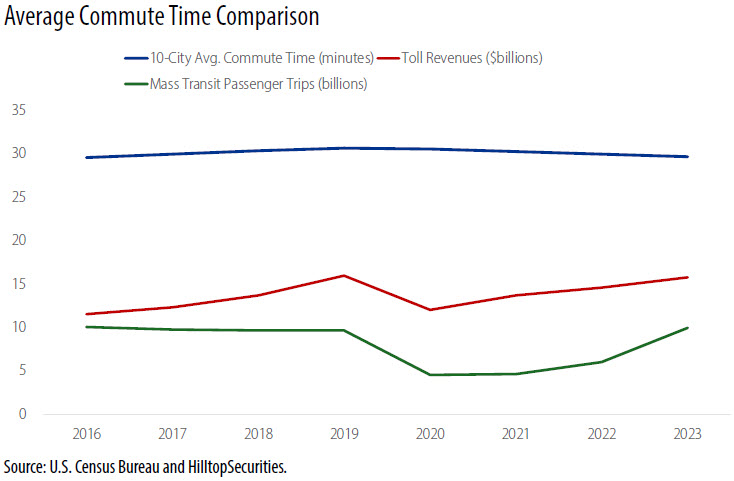

We expect the credit in the Toll Facilities sector conditions to support our “Stable” outlook in 2026. We explored the average commute time across 10 major metropolitan areas through 2023, the most recent year available for most federal data: commute times are still averaging about 30 minutes each way across major metropolitan areas, even with the new normal of regular periodic remote work, and they haven’t appreciably changed for more than a decade. Why? Mass transit – in many big cities a potential competitor to toll roads – continues to struggle to regain previous or attract new ridership. Conversely, toll roads generally got back to pre-pandemic operating revenues by 2022 or 2023 and back to pre-pandemic vehicle-miles traveled by 2024. One reason could be because those workers that do commute are choosing to drive. Because of that, toll roads – especially systems that benefit from economies of scale more so than stand-alone projects – have generally been more resilient.

The higher rated toll road systems had the financial resources to withstand the downturn and often showed a greater demonstrated willingness to adjust tolls (sometimes tied to CPI) if- and as-necessary. The biggest credit challenges could likely be funding major maintenance, lane additions and system extensions given ongoing construction sector inflation.

Water and Sewer

HilltopSecurities Credit Outlook: “Cautious”

Recent Change: No change

Author: Ted Chapman

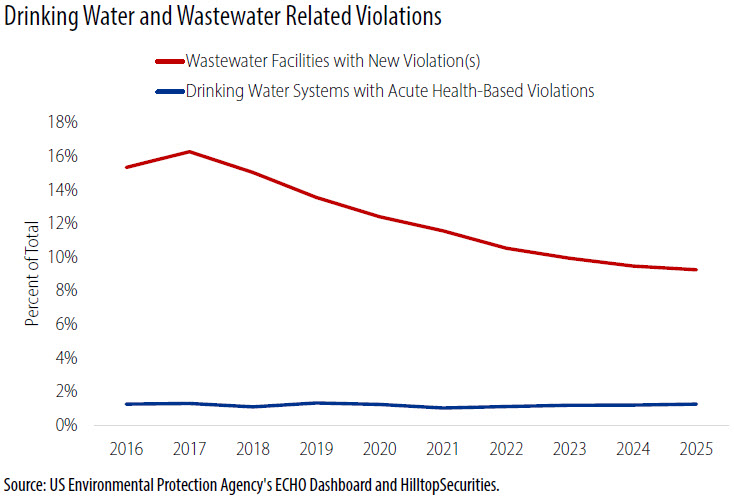

We kept our “Cautious” outlook for 2026 because even though some capital pressures are rolling off, others loom. The number of wastewater facilities reporting new violations has decreased each year since 2017. Meaning the magnitude of borrowing and related rate increases for corrective wastewater projects has plateaued. We view this as important because the regulatory burden has shifted to drinking water and will for some time.

Specifically, by November 2027 utilities will have to start acting on the lead service line (LSL) inventory that they submitted to the EPA in 2024. Specifically, the clock will start ticking on the mandatory 10-year timeline to remove LSLs. Further, the maximum contaminant level (MCL) will be reduced to 10 parts per billion (from 15 ppb); testing for 10 ppb is like finding a single drop in an Olympic-size swimming pool, which in itself pushes the limits of science and is not inexpensive. Until the LSLs are removed, utilities will still have to chemically mitigate the risk the lead leaches into the drinking water. The most common method of chemical treatment is the use of orthophosphates for corrosion control. The residual phosphate compounds, while safe, ultimately end up in the treated wastewater effluent. Unfortunately, excess phosphates – and nitrogen – are extremely common problems for wastewater systems because they can lead to algae buildups and hypoxic dead zones in rivers and lakes, which, ironically, can circularly lead to unfunded wastewater mandates. Meaning as expensive and painful as it will be to deal with LSLs, the long-term cost avoidance is enormous. This also comes as all public water systems have to begin testing for PFAS compounds in 2027, with some MCLs as low as 4 parts per trillion, and will have from 2029 to, in some cases, 2031 to develop treatment methods for PFAS removal. Currently just over 1% of all drinking water systems have acute health-based violations, meaning there is the potential for immediate water-borne illness.

Positive: HilltopSecurities believes there are factors which point towards improving issuer or sector credit quality. This may result in a higher level of credit ratings upgrades versus downgrades if issues are rated.

Stable: HilltopSecurities believes there are factors which point towards stable issuer or sector credit quality. This is likely to result in an even level of credit ratings upgrades versus downgrades if issues are rated.

Unbalanced: HilltopSecurities believes that there are factors that can be positive to the sector in certain states or regions and factors that can be negative to certain states or regions.

Cautious: HilltopSecurities believes there are factors which introduce the potential for declines in issuer or sector credit quality. This may result in credit ratings downgrades only slightly outnumbering upgrades if issues are rated.

Negative: HilltopSecurities believes there are factors which point towards weakening issuer or credit quality. This will likely result in a higher number of credit ratings downgrades versus upgrades if the issues in the sector are rated.

Readers may view all of the HilltopSecurities Municipal Commentary here.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

As Head of Public Policy and Municipal Strategy, Tom Kozlik advises HilltopSecurities’ businesses and clients on strategies related to U.S. public policy, public finance, and infrastructure. He publishes regular commentary that provides insight into current trends affecting these themes across a variety of sectors and geographic regions. Kozlik is frequently featured in print, digital, and broadcast news segments and regularly offers his expertise as a keynote speaker and panelist at industry conferences and events across the country. He can be reached at 214.859.9439 or tom.kozlik@hilltopsecurities.com.

The paper/commentary was prepared by HilltopSecurities (HTS). It is intended for informational purposes only and does not constitute legal or investment advice, nor is it an offer or a solicitation of an offer to buy or sell any investment or other specific product. Information provided in this paper was obtained from sources that are believed to be reliable; however, it is not guaranteed to be correct, complete, or current, and is not intended to imply or establish standards of care applicable to any attorney or advisor in any particular circumstances. The statements within constitute the views of HTS Public Finance as of the date of the document and may differ from the views of other divisions/departments of Hilltop Securities Inc. In addition, the views are subject to change without notice. This paper represents historical information only and is not an indication of future performance. This material has not been prepared in accordance with the guidelines or requirements to promote investment research, it is not a research report and is not intended as such. Sources available upon request.

Hilltop Securities Inc. is a registered broker-dealer, registered investment adviser and municipal advisor firm that does not provide tax or legal advice. HTS is a wholly owned subsidiary of Hilltop Holdings, Inc. (NYSE: HTH) located at 717 N. Harwood St., Suite 3400, Dallas, Texas 75201, (214) 859-1800, 833-4HILLTOP